Credit card details can be sold as digital items on the dark web, with the basics costing around $17.36. The average price for a credit card number, CVV, expiration date, cardholder name, and postal code is $17.36. These groups often originate from leaked credit card credentials, which have become a common phenomenon, particularly in the past months. Telegram carding groups have become a significant threat in the cybercriminal community, with tens of thousands of members easily accessible through the chat application. These checkers are often offered and sold on the dark web, and are complimentary tools that individuals and organizations use to verify credit card information.

The Dark Web’s Largest Forum For Stolen Credit Card Data Is Shutting Down

Here are the top 500 potential affected banks, based on the total count (in descending order) – Withoutdecisive action, these cybercriminals will continue to exploit NFCtechnology, posing a serious risk to consumers and businessesworldwide. Throughadvanced tooling and techniques, such as the “Ghost Tap”method and remote transaction relays, they can bypass detectionsystems and cause significant financial damage to victims. Eventhough individual transactions may be small, the cumulative lossescan be substantial when applied at scale. This growth has created more opportunities for fraudsters to exploit the technology. X-NFC customers are widely using this approach to defraud consumers of airlines, hotels, gas (petro) loyalty programs and steal their points.

Stolen Credit Card Numbers—A Guide To Safeguarding Your Funds

They are essential for executing operations on smart cards, such as reading data, writing data, or performing cryptographic functions. Primarily, the actors use Android-based phones, with numerous cards “loaded” into mobile wallets for further fraud. Resecurityobserved several postings where cybercriminals discussed the tools touse for NFC fraud. Aroundthat time, cybercriminals’ first efforts to develop special tools toenable NFC-based carding were identified.

InfoSec Insider

After obtaining the data, sellers don’t just dump it on markets, they package it strategically. The Magecart group pioneered this technique, compromising thousands of online stores by exploiting vulnerabilities in popular e-commerce platforms. Flare monitors the clear and dark web as well as illicit Telegram channels for high-risk external threats to your organization. Use multifactor authentication to prevent threat actors from guessing at weak passwords, or getting into your systems with a brute force attack.

Carding In 2025: How Cyber Criminals Sell Stolen Credit Cards And Teach Fraud

Hackers steal and sell card data online, putting users at risk. The company’s comprehensive security portfolio includes leading digital life protection for personal devices, specialized security products and services for companies, as well as Cyber Immune solutions to fight sophisticated and evolving digital threats. “It is conceivable that the data was shared for free to entice other criminal actors to frequent their site…by purchasing additional stolen data from unsuspecting victims,” according to the post (machine-translated from Italian). The curators of AllWorld.Cards began flogging their cybercriminal services on carding sites in early June, ostensibly to drum up new business, researchers from Italian firm D3 Lab noted in a separate blog post detailing the leak, published last Friday.

Warning For Would-Be Fraudsters

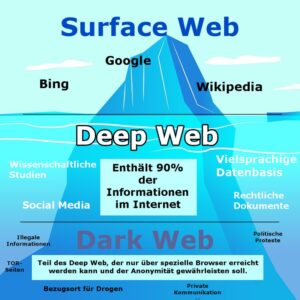

Monitoring the dark web for your credit card number is crucial for anyone who wants to protect their financial security. Conducting transactions online while connected to an unsecured WiFi network places your financial data at risk of being stolen due to MITM attacks. While consumers are typically protected from direct financial losses, dealing with credit card fraud is incredibly disruptive. Banks and credit card companies lose billions annually to fraud, but the real cost isn’t just in fraudulent transactions. The impact of dark web credit card fraud extends far beyond individual card holders. In this post, we’ll cover how credit card fraud operates on the dark web, how criminals obtain and trade card data, and cover some essential prevention strategies.

Service providers play a critical role in the broader financial security ecosystem, so one of the most valuable things you can do is empower your customers with clear, practical advice. These tools offer consumers the most effective way to defend against carding attacks. Carding has long been a prevalent form of online crime—and it remains a serious threat. While stealing card data can sometimes be relatively easy, successfully using it is far more difficult.

What Are Dark Web Credit Card Numbers?

Follow reliable cybersecurity sources that provide updates on new threats and scams targeting credit card information. Be cautious when making online transactions, especially when it comes to sharing credit card information on the dark web. By regularly monitoring your credit, using secure payment methods, and being cautious online, you can minimize the risk of your credit card falling into the wrong hands. For example, hackers may sell credit card information in bulk, allowing others to commit fraud and financial theft. Additionally, securing personal information and maintaining cautious online behavior can minimize the risk of falling prey to credit card fraud on the dark web.

The dark web provides an anonymous and unregulated platform for these transactions, making it difficult for authorities to trace and shut down such activities. These financial losses can have a lasting impact on victims’ financial stability and may require extensive efforts to resolve the issue and regain control over their finances. Once obtained, this information is used for identity theft, fraudulent purchases, and money laundering. Information in the listings was entered into a spreadsheet for data analysis and statistical calculations. Social Security numbers and other national ID numbers are for sale on the dark web but aren’t particularly useful to cybercriminals on their own. On top of all that, they could make purchases or request money from contacts listed in the PayPal account.

- If your credit card information is exposed, it can be used for unauthorized purchases.

- Spotting credit card fraud takes sharp eyes.

- Pretty much everything you would need to commit credit card fraud or launch phishing attacks against the cardholder.

- Fullz that come with a driver’s license number, bank account statement, or utility bill will be worth more than those without, for example.

- But that’s not all; there are also cardholder details such as their full name, address, date of birth and telephone number as well as email address.

For fledgling criminals who don’t know how to use stolen credit cards, there are plenty of free and paid tutorials for carding on the dark web. Password managers like Keeper are tools that not only aid in securing your online accounts, but also your most sensitive information – including your credit cards. The sale of payment card information is big business; in 2022, the average price of stolen credit card data averaged between $17 and $120, depending upon the account’s balance. Card data is a hot commodity on the dark web, with credit card details and cloned cards being sold to cybercriminals.

- After obtaining the data, sellers don’t just dump it on markets, they package it strategically.

- Platforms such as UniCC function as an underground marketplace wherein credit card details stolen from online retailers, banks, and payments companies by injecting malicious skimmers are trafficked in exchange for cryptocurrency.

- Criminals steal card details and sell them online.

- Dark web credit card numbers are stolen card details sold on hidden websites.

- While the virtual card is tied to your real account, the merchant or a potential hacker can’t access your actual bank details.

- The average price of a PayPal account across all of the marketplaces we examined was $196.50, with an average account balance of $2,133.61.

Unauthorized Purchases

One common technique involves acquiring stolen credit card data from online marketplaces on the dark web. In total, the analysis included more than 200 listings for PayPal accounts and about 400 listings for credit cards. So unlike credit cards, prices for PayPal accounts and transfers have gone up during the pandemic by 293 percent. For this study, the researchers focused on PayPal accounts and credit cards.

Common Scams On Dark Web Marketplaces

You can sometimes opt in and out of MFA in your account settings. Using MFA can help keep others out of your account even if your username and password are leaked on the dark web—or elsewhere. Multifactor authentication (MFA) requires you to use two or more forms of authentication to access your account. The threat actor behind the AllWorld Cards marketplace has a clear goal in mind. Some vendors even sell lists of “cardable” sites for a few dollars. Credit card prices also vary depending on the brand, with American Express being worth the most at 5.13 cents per dollar.

I’ve seen cases where security teams identified compromised card data from their institution appearing on the dark web weeks before they traced the actual breach point. These systems can often identify when stolen card data is being tested before major fraud attempts begin. But first, how big of a problem is credit card fraud on the dark web? Dark Web credit card fraud is an ongoing problem and is not showing any signs of going away. When it comes to credit card fraud, the best offense is a strong defense. It’s important to detect fraud when a threat actor is trying to use stolen payment information to make a purchase from your business.

Protecting your personal information is vital when it comes to guarding against credit card fraud on the Dark Web. By choosing a secure payment method, you can significantly reduce the chances of your credit card information falling into the wrong hands. Protecting your credit card information is crucial to avoid financial loss and potential legal troubles.