The main risk is that the owner realises a second user is on the account and changes their password. By piggybacking on an existing account, the purchaser gets to use the service for free. This approach is somewhat popular with subscription services like Netflix. The main risk is that the owner will realise that the account has been hacked and attempt to recover it through customer support.

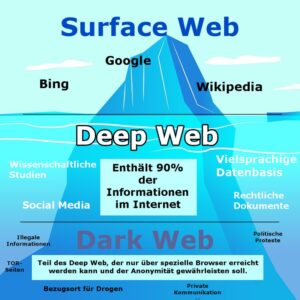

For fledgling criminals who don’t know how to use stolen credit cards, there are plenty of free and paid tutorials for carding on the dark web. Physical cards are usually cloned from details stolen online, but can be used to withdraw from ATMs. When a hacker writes up new malware, steals a database, or phishes someone for their credit card number, the next step is often toward dark net marketplaces.

Black-Owned Banks FAQs

He can wire transfer or deposit money directly into the US bank accounts oflegitimate companies in exchange for goods. So as banks around the world became stricter about money laundering laws,Colombian traffickers began avoiding using the legitimate bank system andstarted infiltrating the black peso exchange to launder their drug money. While there are challenges, the introduction of sweeping foreign currency special purpose call accounts offers a promising path forward for Ghana to address the longstanding issue of black-market currency trading. The operationalisation of sweeping foreign currency call account hinges on banks’ ability to develop advanced financial technologies. As customers shift their foreign exchange activities from informal traders to formal institutions, banks will see an increase in deposits, foreign exchange transactions, and overall customer engagement. While the Bank of Ghana and local banks try to stabilise the cedi and manage inflation, the black market continues to attract clients seeking better deals, faster service, and less bureaucracy.

Compromised Accounts That Do Not Lock The Owner Out

Since Black-owned banks primarily serve minority communities, these institutions aren’t able to offer the same variety of products and services as national banks, and as a result, have more limited opportunities for access to capital. Banks can raise capital by providing a variety of services and products, like loans or bank accounts, and imposing fees. The importance of Black-owned banks lies in their abilities to provide access to banking services for underserved communities. We’ve provided a detailed list of 36 Black-owned banks and credit unions divided by state to help you find a Black-owned bank that fits your banking needs. Establishing a banking relationship with Black-owned banks helps to counteract these systemic inequities and provides financial resources to communities that have been underserved.

What Are Stolen Credit Cards Used For?

Next you need to set up an account with the largest bitcoin exchanger, MtGox. Start by opening a Dwolla () banking account with no fees. There are two steps to legally take money and have it converted at the current Bitcoin rate into BTCs in our digital and anonymous bank. Bitcoin () is system tool that will act as a personal bank for storing and investing digital currency on your computer.

How Hackers Monetize Stolen Personal Data

“Because the black market people use a different IP address or something. I don’t know.” Luckily, they were able to assist her and waive these charges. The young woman finally called her bank to notify them that her card got hacked – and she learned that the bank had three pages worth of charges from different countries on her account after they looked into it. And this guide’s 7 ways to protect your identity online and offline can provide additional tips to safeguard your personal information. Choosing a strong password for every online account can help protect your personal information. That way, you’ll know about recent credit inquiries, delinquent accounts and more.

Topics And Products Sold

- About 10.6% of Black American households are unbanked, compared with 1.9% of white households, according to a 2023 survey by the Federal Deposit Insurance Corp.

- This enables them to penetrate the credit card processing chain, overriding any security countermeasures.

- Use a password manager to help generate strong and unique passwords for each one of your social media accounts.

- If someone discovers your personal information on the dark web, it may indicate that they obtained it against your will.

An eBay account with a high reputation (1,000+ feedback) might reach $1,000. Hackers ask for $8 for a hacked Uber account and $14 for a hacked Uber driver’s account. And the USA Voter database from various states costs $100.

Because these dark web marketplaces attract, by their very nature, the criminal element of society, the items on offer reflect this. And then along came the Flashpoint analysts who found even bigger illicit “bargains” in these dark web marketplaces. On September 13, I wrote about how an earlier dive into the dark web economy by Armor Threat Resistance Unit researchers revealed it was possible to exchange $800 (£630) of Bitcoin for $10,000 (£7,900) cash. Sourced from the most popular cybercrime marketplaces, some of which have been closed down now as my colleague Zak Doffman wrote earlier in the year, the prices remain representative of the dark web as a whole today. Flashpoint intelligence analysts have taken a look at the cybercrime economy through the lens of dark web marketplace prices over the last two years. Requiring specific software to access the dark web sites themselves, most commonly the Tor browser, this small corner of the internet is both an anonymous haven for whistleblowers and political activists, as well as a highly profitable marketplace where criminals sell their ill-gotten goods.

For years, Nigerians in the diaspora have had to deal with fluctuating exchange rates, leading many to turn to the black market for better deals. For those unfamiliar, this unofficial parallel exchange market plays a massive role in Nigeria’s foreign currency trade. The use of 3D Secure has been shown to reduce the number of card-not-present (CNP) transactions, which are often targeted by black market sellers. To combat the black market, card issuers are implementing new security measures, such as 3D Secure, which requires cardholders to authenticate transactions with a one-time password. Black market credit cards are often obtained through the dark web or by purchasing them from unscrupulous sellers. This is a staggering amount, and it’s no wonder that financial institutions are taking steps to prevent the sale of stolen credit card information.

Thomas Patterson And Piedmont Credit Union—the First Black Credit Union

The emotional toll, anxiety, mistrust, and constant fear of another attack can outlast the financial recovery. Victims of identity theft often describe the experience as invasive and exhausting. Its effects ripple across financial systems, businesses, and society at large. Using stolen credentials, hackers infiltrate vendors or partners to reach larger networks.

Additionally, biometric facial recognition technologies can be used to offer remote identity verification via face scans. There are many techniques to prevent identity fraud that businesses and individuals can use. Once the relationship between a customer and a business has been repaired, the costs of data breaches continue. Some thieves would even search through the trash for papers that contained personal information. Some people attempt account hacking or use malware to collect credentials. If someone discovers your personal information on the dark web, it may indicate that they obtained it against your will.

13 ICE’s El Dorado Task Force consists of members from more than 55 law enforcement agencies in New York and New Jersey working in partnership to target vulnerabilities and financial crimes in the New York/New Jersey metropolitan area, such as commodity-based money laundering. 5 According to FATF, the other two methods used by criminal organizations and terrorist financiers to move criminal proceeds and integrate them into the formal economy are use of the financial system and physical movement of money (e.g. through the use of cash couriers). While SAR filings related to trade-based money laundering are increasing, the activity dates reported on the SARs indicate there is a substantial interval between when the activity occurs and when it is identified and reported. Further information on trade-based money laundering, and related SAR filings, can be found in Appendix A. It is important to remember that no one activity by itself is a clear indication of trade-based money laundering.

According to the Dark Web Price Index 2021 by Privacy Affairs, cybercriminals can make quite a profit from hacked personal data. Buyers can purchase the stolen data they are interested in and use it for their malicious activities. After stealing your personal information, hackers organize it in a database that they monetize in various ways.

A Black-owned bank is a for-profit banking institution in which the majority of stockholders or members of the board of directors are Black Americans. Many are community development financial institutions, which provide financial services in underserved and low- to moderate-income areas. He has covered personal finance since 2013, with a focus on certificates of deposit and other banking-related topics. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free. Make sure you are taking the necessary steps to protect your personal data and are constantly reviewing areas that criminals could potentially compromise. Private computers, on the other hand, are an excellent starting point for a career as a blackmailer – or for someone specializing in identity theft.

The Bank of Ghana and the formal financial sector are subject to strict foreign exchange regulations, which cap the amount of currency a person or business can purchase. Black market operators frequently build personal relationships with clients, offering negotiable rates based on the volume of currency exchanged, and even delivering currencies directly to clients. Foreign currency black markets in Ghana have roots that stretch back to the early days of the country’s independence. Ghana, in particular, has seen a consistent struggle to regulate its foreign exchange market, leading to the persistence of underground trading and informal exchanges.